INNOVATION | 02.09.2025

How has the insurtech ecosystem in Latin America started off in 2025?

After several years of funding at historic lows, the insurtech ecosystem in Latin America is starting 2025 on the rise: more investment, more startups, and a hopeful outlook for entrepreneurs. The promotion of regional partnerships and public-private collaboration is fundamental in this snapshot.

The first six months of the year are marking a before and after in the Latin American insurtech market. With funding reaching $121 million, the figure already surpasses the total investment for all of 2024 by 32%. This milestone highlights the region’s potential and the resilience of the ecosystem, which continues to navigate global uncertainties and inflationary pressures while responding positively with compelling value propositions that consistently attract new rounds of investment.

This context is intrinsically linked to the growth of the global economy and, specifically, that of Latin America. According to the report2025 Economic and Industry Outlook prepared by MAPFRE Economics, MAPFRE’s research arm, growth for the world economy is estimated at 2.9% this year, two tenths above the forecasts made a few months ago.

The same report states that Latin American countries as a whole will increase their GDP by 2.1% this year and more than 2% next year. Inflation in this economic area remains at 8.8% for 2025 and at 8.1% in 2026, still influenced by price growth in Argentina.

“This beginning of the year has revealed very positive data for the Latin American insurtech ecosystem. In general, all countries or regions continue to grow or strengthen,” comments Carlos Cendra, Scouting & Investment Lead for Corporate Innovation at MAPFRE. “In fact, in terms of funding, investment levels in just the first half of the year have already reached pre-pandemic figures and, if the current momentum continues, they could surpass the $221 million invested in 2022,” he notes.

Entrepreneurs remain strong

The more than 100 million dollars in funding in the first half of 2025 exceed the results for the same half of 2024 by 370%, according to the Latam Insurtech Journey report, prepared by Digital Insurance LatAm with the sponsorship of MAPFRE.

“This significant increase in funding compared to previous years and semesters has been driven by the resilience of entrepreneurs.” Startups have remained resilient during the “lean years,” and investors are backing those that have been able to set out a clear growth roadmap and demonstrate long-term profitability, states Carlos Cendra.

The investment flow is concentrated mainly in Brazil, which accounts for $89 million, or 74% of total investment in the first half of the year. In terms of business lines, Life & Care captures 65% of the investment, while the mobility sector represents 33%, underscoring the strong interest in both areas

Analyzing the total number of agents, the Latam Insurtech Journey report indicates that there are currently 507 insurtechs in the region, which represents a 2% growth, remaining positive, although with a certain slowdown compared to what we have seen in recent quarters.. Brazil (206), Mexico (129), and Argentina (95) are the markets with the largest number of players, while Chile stands out with the highest percentage increase (+29%), acting as the region’s growth engine thanks in part to its low attrition rate.

A key factor for this development is internationalization: in the first half of 2025, there has been a 36% increase in the expansion of Latin American insurtechs to other markets —that is, the number of multilatina startups continues to increase. Peru (58%), Chile (31%), and Colombia (26%) are the main drivers of this increase, and Brazil now has 10% of international insurtechs, which represents a very relevant figure given the endogamic nature and characteristics of the market.

“In these first few months, we have seen how startups like Sami (backed by Mundi Ventures), Olé Life, and Azos have raised significant rounds. With their support, along with that of other major players with an international presence, such as Blue Marble or Past-Post, the outlook for the rest of the year appears positive—particularly given the push coming from regional associations and the efforts being made through public-private collaboration,” explains Carlos Cendra.

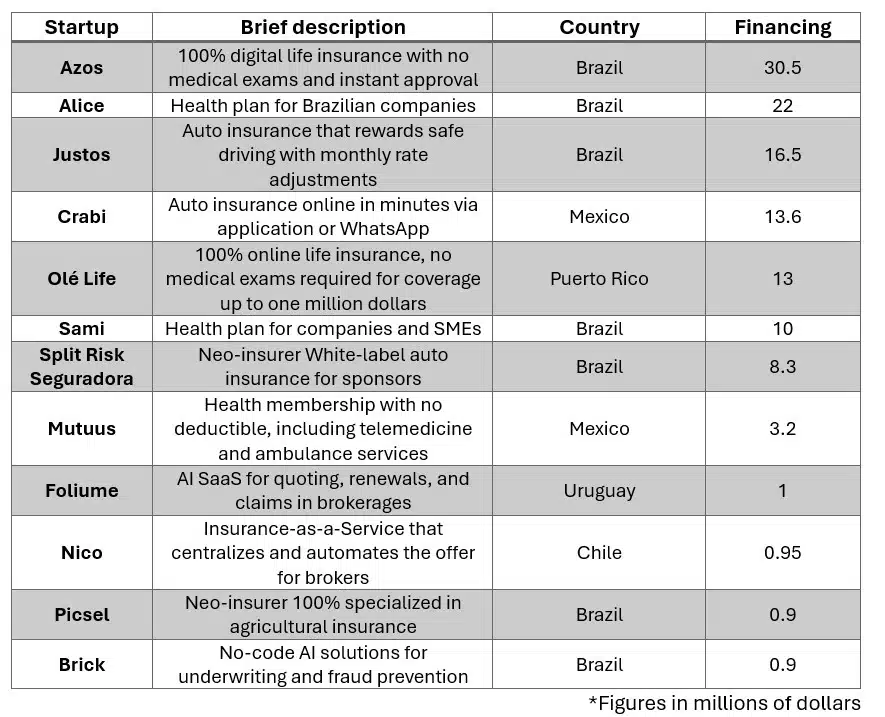

Largest investments for the first half of 2025

Not all funding rounds are public, but looking at those that are, the largest investments made during the first six months of 2025, as per data from the latest Latam Digital Insurance report, are as follows:

RELATED ARTICLES: