ECONOMY| 07.31.2025

The nine key risks for the global economy in 2025

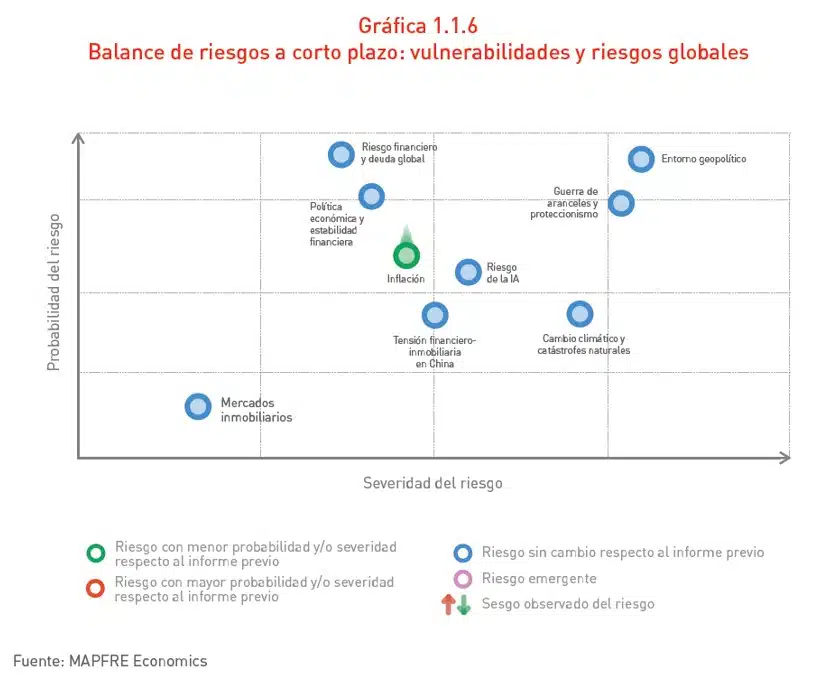

The global economy faces a 2025 full of uncertainties and challenges. From rising debt and persistent inflation to the effects of climate change and geopolitical tensions, the risks are diverse and profound.

The report Economic and Sectoral Outlook 2025: Perspectives for the Second Half of the Year, prepared by MAPFRE Economics and published by Fundación MAPFRE, provides an assessment of the most relevant risks that could impact global economic stability.

- Financial risk and global debt

One of the main identified risks is the high level of public and private debt, which exceeds 256% of global Gross Domestic Product (GDP). This increase, observed in both advanced markets and emerging markets, has been exacerbated by the rise in government bond yields in the long term. In the United States, the yield on the 10-year bond has reached historic levels, increasing the debt service and putting pressure on public finances. This scenario is aggravated by restrictive monetary policies that seek to contain inflation, but that hinder debt sustainability: with higher rates, there will be a greater increase in the cost of debt.

- Trade war and protectionism

The protectionist policy of the U.S. through imposing tariffs aims to reduce the trade deficit and, at the same time, increase government revenue. It is expected that the cost of these tariffs will be borne, in part, by consumers and, in another part, by manufacturers. The goal of reducing the trade deficit is not easy to achieve, as many imported products cannot be manufactured in the United States, or only at a much higher cost. However, it is expected that, in certain industries, such as steel or automobiles, some of the manufacturing will be mobilized to the U.S.

- Inflation

Significant progress has been made in reducing global inflation, with most advanced economies showing sustained declines in price indices. However, the 2% target set by many central banks is proving more difficult to achieve. Recent data indicate a slight upturn in inflation in some regions, raising concerns about the persistence of inflationary pressures.

- Monetary policy and financial stability

The central banks of the G7 countries have begun a cycle of interest rate reduction, driven by progress in inflation control. The exception is the United States, which has kept them in 2025 awaiting the opportunity to assess the impact of tariffs. More persistent inflation and rising government bond yields increase the risk that both governments and the private sector must refinance their debts at higher rates; more expensive financing leads to moderation in credit demand and, therefore, lower levels of investment and economic activity.

- Geopolitical environment

In the geopolitical landscape, following the United States' attacks on Iranian nuclear facilities, oil prices reached five-month highs. However, with the ceasefire (albeit fragile and lacking substantial negotiation), Brent crude oil has returned to around $70 per barrel. Likewise, the conflict in Gaza and the conflict in Ukraine remain unresolved and continue to be human dramas, although it seems that the economy of the rest of the world continues on its course. Apparently, Europe has managed to find alternative sources to Russian gas and oil, although it is unclear whether it continues to purchase them indirectly to some extent. Another aspect to watch is the growing influence of the BRICS, which advocate for a gradual reduction in the use of the dollar in international transactions.

- Financial and real estate tension in China

The Chinese real estate sector is facing significant challenges. Sales of new homes have decreased, and property prices continue to fall. Some market observers expect sales to fall by 12% in 2025, with a notable decrease in housing prices. The difficulties in the Chinese real estate sector may affect both the national economy and global financial stability. These tensions in the property market increase the risk of debt defaults among developers, which could affect the banking system due to financial institutions’ significant exposure to the sector.

- Real estate market

In developed markets, the residential sector has shown resilience, with notable increases in housing prices. However, the commercial and office real estate sector faces significant challenges both in the United States and Europe. The pandemic accelerated trends such as teleworking, reducing the demand for office spaces and increasing vacancy rates. In addition, the increase in government bond yields has increased real estate financing costs, which may negatively affect property valuation and increase the risk of financial instability.

- AI risks

Artificial intelligence (AI) represents a tool with enormous potential for global economic growth, but it also introduces significant risks to financial and social stability. In financial markets, the use of automated trading algorithms has raised concerns about their potential to amplify volatility during periods of stress. These algorithms, designed to execute transactions within fractions of a second, can trigger chain reactions that exacerbate market downturns, as seen in events like the 2010 "flash crash." The lack of supervision and transparency in programming these algorithms could intensify these risks, especially if they interact with other factors of economic instability.

- Climate change and natural disasters

The impact of natural disasters continues to be a significant risk. In 2024, global temperatures rose by an unprecedented 1.55 °C above pre-industrial levels, marking the warmest year on record. This led to global economic losses from natural disasters totaling $320 billion, of which only $145 billion were insured. This increase has intensified phenomena such as heat waves, cyclones, and floods, underscoring the urgent need for adaptation measures.

Conclusion

The balance of risks in 2025 presents a complex and challenging outlook for the global economy. High levels of debt, geopolitical tensions, the effects of climate change, persistent inflation, and uncertainty in financial markets are factors that require special attention from governments, financial institutions, and market players. International cooperation, the implementation of effective policies, and the adaptation to new global dynamics will be essential to mitigate these risks and ensure sustainable economic stability. In this context, the art of negotiating and the ability to adapt to a changing environment become fundamental tools to face the challenges of the future.

RELATED ARTICLES: