CORPORATE|07.28.2025

MAPFRE Economics improves the global growth forecast for 2025 by two tenths to 2.9%

- Global inflation will be 3.4% in 2025 and 2.9% in 2026.

- The impact of trade policy and geopolitics on the economy has softened in recent months.

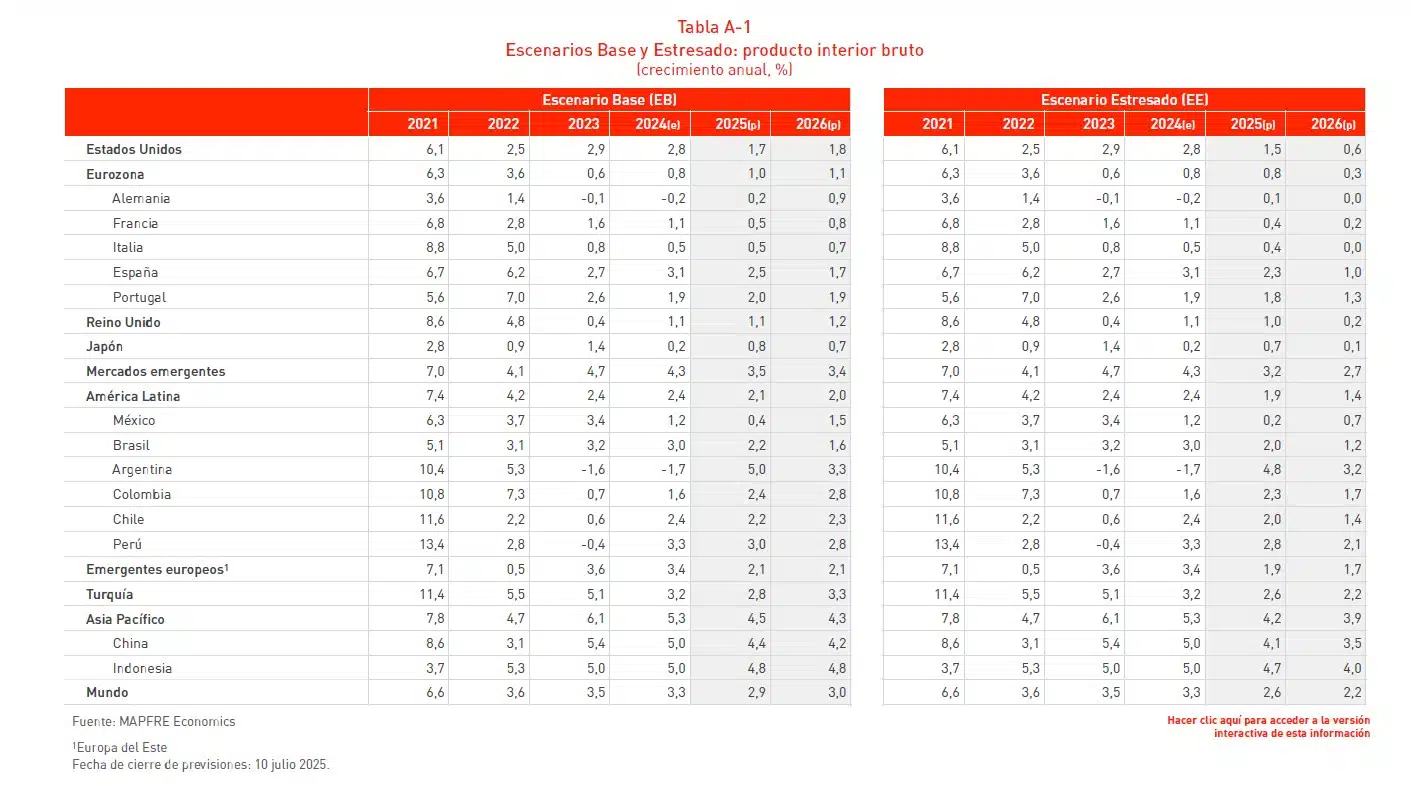

MAPFRE Economics, MAPFRE’s research arm, estimates a growth for the global economy of 2.9% this year, two tenths higher than the forecasts made a few months ago, and 3% for next year, with inflation expected to be 3.4% and 2.9%, respectively, according to the report ‘Economic and Sectoral Outlook 2025: Perspectives for the Second Half of the Year,’ published by Fundación MAPFRE.

MAPFRE Economics explains that the first half of the year has been overwhelmed by a layer of global uncertainty stemming from trade policy and geopolitics. However, both variables have been softening recently and, although they remain at elevated levels, they are so far “reasonably innocuous” at the macroeconomic level.

The forecast for the United States has worsened by two-tenths compared to the previous report, with estimated growth of 1.7% this year and 1.8% the following year, with inflation at 3% for 2025 and 2.6% for 2026. According to MAPFRE Economics, the rise in financing costs due to a reduced appetite for domestic bonds is among the main short-term risks for the U.S. economy.

The Eurozone will continue to show weak performance, though with some improvement, as the effects of the interest rate cuts implemented by the European Central Bank (ECB) continue to be transmitted to the real economy. MAPFRE Economic Research has improved its growth forecast by two-tenths to 1% this year and maintains the 2026 forecast at 1.1%, with inflation at 2% and 1.8%, respectively.

The group of emerging countries is expected to experience growth of 3.5% in 2025 and 3.4% in 2026, with inflation rates of 4.1% and 3.6%, respectively, while Latin America is projected to see GDP growth of 2.1% this year, two-tenths higher, and 2% the following year. Inflation in this economic area remains at 8.8% for 2025 and at 8.1% in 2026, still influenced by price growth in Argentina.

In the Asia-Pacific region, the estimated growth increases by two-tenths to 4.5% for 2025 and decreases by one-tenth to 4.3% for 2026, with an improved growth forecast for China of four-tenths for this year, up to 4.4%, while its GDP is expected to grow by 4.2% in 2026. China’s economy has remained resilient despite continued weakness in the real estate sector, although inflation is slightly negative, raising doubts about the strength of domestic consumption. Inflation in the country is estimated at 0.2% this year and 0.8% the following year.

Impact on the insurance industry

The evolution of the global insurance market reveals a divergence in growth trends between the Life and Non-Life insurance segments, with an increase of 6.2% in the Life segment and 5.2% in Non-Life, correlated with the behavior of the global macroeconomic environment. For 2026, despite a landscape characterized by easing inflationary pressures and a more flexible financial context, a slight slowdown is expected in the Life segment, with estimated growth rates of 6%, and around 5.3% for the Non-Life insurance segment.

This adjustment would be a response to the persistence of geopolitical uncertainties and the evolution of economic policies in major economies—factors that directly influence the risk perception of economic agents and the dynamics of their insurance decisions.